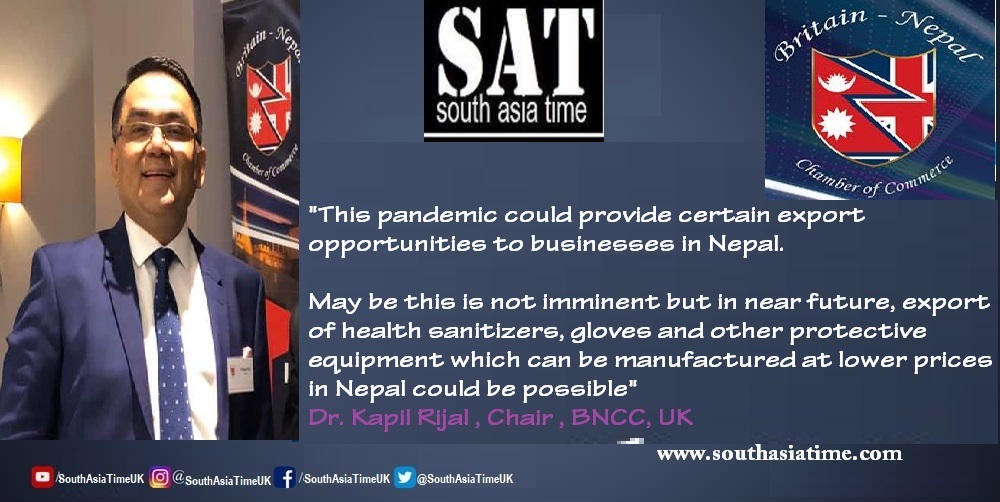

‘We are working on to support Nepali businesses in the UK’- Dr. Rijal

President of Britain-Nepal Chamber of Commerce (BNCC), DR KAPIL RIJAL, is a successful business person himself. A senior dentist who owns his own dental practices in the UK, Dr. Rijal has a special interest in Dental Implants. His hobbies include directing films, writing stories and screenplays. He spoke to SOUTH ASIA TIME on the impact of the coronavirus crisis on Nepali businesses in the UK. Excerpts of the interview:

President of Britain-Nepal Chamber of Commerce (BNCC), DR KAPIL RIJAL, is a successful business person himself. A senior dentist who owns his own dental practices in the UK, Dr. Rijal has a special interest in Dental Implants. His hobbies include directing films, writing stories and screenplays. He spoke to SOUTH ASIA TIME on the impact of the coronavirus crisis on Nepali businesses in the UK. Excerpts of the interview:

Dr Rijal spoke to SOTUH ASIA TIME on the impact of the coronavirus crisis on Nepali businesses in the UK. Excerpts of the interview:

Nepali Business Community in the UK has been badly affected by the coronavirus crisis. Some businesses are closed and many people have lost jobs. What is the BNCC doing to address the situation?

Corona virus pandemic has significantly affected many businesses including those run by Nepalese community. The government has made available a full range of support measures to UK businesses and employers. Unfortunately, a lot of Nepalese businesses are not aware of those measures and those who are aware do not know how to access these. As a business organisation we have just published a newsletter. In this newsletter we have brought together what the businesses and individuals need to know about the Government help and how these government measures can support them or their businesses and how they could access these measures. We believe that this could provide useful information to our business members and wider Nepalese community. Also, we have regularly brought Nepal Embassy’s attention to provide necessary support for those in need in particular Nepalese students studying in various colleges and universities across the UK.

Can you please elaborate on the BNCC’s plans to help Nepali business entities?

Due to the current social distancing measures introduced by the government we have not been able to organise any social interaction or our usual networking programmes. However, we have tried to use the social media and digital platform to make Nepalese businesses aware that there are support measures that the UK government has made available which we believe they should seek immediate access to. There are a lot of Nepalese people who are running or working in hospitality, leisure and retail sectors and these are the sectors which have been severely hit by the impact of Corona virus. The government has introduced very comprehensive support measures such as cash grant, business rates holiday, grants for employers to pay staff costs, support for tenants, deferral of tax payments etc and these measures could significantly help the individuals and businesses to get through this difficult time.

We are also looking at some collaboration with other Nepali organisations to support Nepali students who may be in a difficult situation. Some of them have lost their jobs and place to live in. Finding them a place to live in for a temporary period of time as we are sure they will again be able to find jobs when things get back to normal.

This pandemic could provide certain export opportunities to businesses in Nepal. May be this is not imminent but in near future, export of health sanitizers, gloves and other protective equipment which can be manufactured at lower prices in Nepal could be possible. Governments around the world would like to have these at their disposal and Nepali businesses could potentially explore this opportunity. We can certainly help those businesses who are trying to explore opportunities in the UK market.

The BNCC was taking initiatives to promote British investment in Nepal? How will the corona crisis affect this?

Obviously, it will have a significant impact in the shot-term and some impact in the medium term. Many businesses in the UK are having severe cash flow problems due to this pandemic and in this environment, survival is the key for these businesses and they are more than likely to defer their investment decisions. Also, Nepal is suffering especially in the hospitality sector where hotels and restaurants are empty, airlines are struggling, and many trekking agencies’ existence is in threat. Businesses would not want to invest to increase the capacity now.

BNCC was planning to take a trade delegation to Nepal last month which we had to cancel due to the current environment. There was a significant interest from the UK businesses to invest in Nepal especially in Hospitality and Education sector. We will now need to wait for a right time to take such delegation.

The airlines industry has been badly affected by the corona crisis. How do you see the possibility of Nepali airlines coming to Britain after Brexit?

As you probably aware certain airlines are banned from operating in European airspace (including UK airspace) because they are found to be unsafe and/or they are not sufficiently overseen by their authorities. Sadly, Nepal Airlines is one of them. The ban has not been lifted for a number of years sighting lack of improvement in safety oversight by the country’s aviation regulator (CAAN). CAAN had failed to convince EU air safety experts about any improvement made. Post Brexit we do not believe UK will maintain lower standards than the current EU standards. Unless the concerns raised by European Union are adequately addressed, we do not think Nepalese Airlines could fly to the UK anytime soon. As a business body, we will continue to push CAAN to improve its standards and adequately address the concerns raised by the European Union. This is the only way Nepalese Airlines could fly to Europe including the UK and tap the growing tourism market.

Coronavirus Government Business Support Guide Prepared by: Indra Giri, FCCA (Chartered Certified Accountant & Registered Auditor)

The Coronavirus (COVID-19) pandemic and associated shutdown has significantly affected many businesses. We know you may be suffering in terms of cash flow and face enormous uncertainty about the future for your business.

In this newsletter we have brought together what you need to know about the Government help available for small businesses. HMRC is automatically deferring the next VAT and Income Tax bills, and it will agree extra time for you to pay Corporation Tax and PAYE, but those terms need to be negotiated individually.

Unfortunately, it takes time to set up new systems to provide cash injections directly into businesses, but there are Government grants on their way to the Self-employed and employers to cover 80% of profits or wages. We explain who will qualify for these grants.

A large number of businesses will have their Business Rates bill for 2020/21 wiped out, and smaller businesses will be eligible for cash grants of £10,000 or £25,000 from their local authority.

If you are renting your home or business premises and are having difficulty in paying your rent, you should speak to your landlord. The law has been changed to require the landlord to give you at least three months’ notice to leave the property.

If you are worried that your business has more outgoings than sales and is heading for bust, any of these measures may be able to help you. The Government has temporarily changed the rules on wrongful trading to allow companies to pay staff and suppliers even if the directors fear this could mean the company is made insolvent. Your creditors will not be able to force your business into administration or liquidation for a temporary period during the pandemic.

1 Grants for employers to cover salaries

The aim of the Coronavirus Job Retention Scheme (CJRS) is to enable employers to retain employees who will be needed when the business begins to rebuild in the future (when the pandemic has eased), rather than having to make them redundant. It does so by creating a new category of employment, known as a ‘furloughed employee’.

Who can claim it?

Available for any employee who was on payroll at 28 February 2020.

Any UK business, whether small or large, charitable or non-profit can utilise the scheme.

Employees you can claim for

You can only claim for furloughed employees that were on your PAYE payroll on or before 28 February 2020.

Employees hired after 28 February 2020 cannot be furloughed and claimed for in accordance with this scheme.

Eligible employees include apprentices, agency workers, those on zero-hours contracts, those on fixed-term contracts and salaried members of LLPs. An employee does not have to accept furlough if offered, but the employer could make the employee redundant instead, as long as the appropriate employment law procedures are followed.

To be eligible for the grant, when on furlough, an employee cannot undertake work for, or on behalf, of the organisation.

If you made employees redundant, or they stopped working for you on or after 28 February 2020, you can re-employ them, put them on furlough and claim for their wages through the scheme.

What can you claim?

Government will provide a grant (not a loan) to the employer to cover, for each employee

- 80% of the employee’s regular wage (capped at £2,500) per month plus

- The related employer’s NIC and minimum Auto Enrolment Employer Pension Contributions on that wage

The base for the 80% calculation is the employee’s actual salary as of 28 February 2020. For employees who pay varies, you need to use average monthly earnings for the year.

The employee remains subject to employment law in the normal way, so will retain normal employment rights. Thus, Furloughing will need the agreement of the employee.

How can you claim this grant?

You need to submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal. HMRC are currently working on to set up the online portal and this is expected to be ready by the end of April. Once the system is ready, employers would be able to submit a claim.

Owner-managed companies

Many director/shareholders pay themselves small salaries and the balance of their income as dividends from their companies. The CJRS does not cover the payment of dividends; only the salary paid under PAYE is eligible for the grant available under the scheme. HMRC has confirmed that office holders, such as directors of their own company who do not have a contract of employment, can be furloughed. However, those directors must not provide any services to or on behalf of the company, or generate any income for the company while they are furloughed. Directors can undertake statutory duties while furloughed that would reasonably be judged as necessary, such as submitting statutory returns and supplying information to HMRC. Directors of their own companies are not eligible for help under the Covid-19 Self-employment Income Support Scheme (SEISS)

2 Grants for the Self-employed

The Government will provide funds directly into the bank accounts of Self-employed individuals whose businesses have been adversely affected by the COVID-19 pandemic.This self-employment income support scheme (SEISS) will pay 80% of the average monthly profits over the last three years, up to £2,500 per month. This grant is expected to be payable for up to three months. It will be paid in one lump sum for three months and will be available from early June.HMRC will contact those self-employed people who qualify and there will be an online form on gov.uk for claiming the grant. In order to receive this taxable grant, you must meet all these conditions:

- have traded as Selfemployed in 2019/20 and are still trading (or would trading if it were not for the business disruption caused by COVID19)

- you expect to continue to trade in 2020/21

- you receive more than half of your taxable income from selfemployment, even if you also hold an employed position.

- you are registered with HMRC as Selfemployed and submitted a tax return for the tax year 2018/19; if you haven’t submitted your 2018/19 tax return yet, you can still qualify if you submit it by 23 April.

- your average taxable profits must be less than £50,000 per year; if your profits are £50,000 or more you will receive no SEISS grant at all. HMRC will work out how much grant you will receive based on your tax returns for the three years to 2016/17 to 2018/19. If you started trading during that period HMRC will only use the periods for which you traded to calculate the grant. This scheme will not cover anyone who started trading on or after 6 April 2019.

3 Deferral of Income Tax

The next big Income Tax payment deadline is 31 July 2020. If you pay at least £1,000 of tax with your Self-assessment tax return, the payment due on 31 July is half of your estimated tax bill for 2019/20. But this year you can defer that payment until 31 January 2021, without being charged interest for late paid tax. You don’t have to apply to HMRC, as it won’t be demanding the tax due. However, if you normally pay your Income Tax by direct debit, you should cancel that direct debit with your bank, as HMRC can’t do that for you. If the direct debit remains in place, the tax will be collected as shown on your tax statement. This tax payment deferral applies to anyone who has to make payment of Income Tax on account by 31 July 2020, including employees who need to pay tax on other income such as rent or dividends. If you don’t want to delay paying the tax due on 31 July, you don’t have to, you can pay by electronic transfer or direct debit as normal. Paying the tax now will avoid a larger amount becoming due by 31 January 2021.

4 Deferral of VAT

All VAT registered businesses can enjoy an automatic deferment of their VAT payable in the period from 20 March to 30 June, to help them manage cash flow during the pandemic. If you normally pay your VAT by electronic transfer you can simply not make the payment due in the period to 30 June. You don’t have to inform HMRC why the payment is not made. HMRC’s systems should be adjusted so that default penalty surcharges are not trigged by payments not arriving in the period from 20 March to 30 June. HMRC will not charge interest on the deferred VAT payments

5 Sick pay support for employers

Statutory sick pay (SSP) must be paid by employers to their employees who qualify, both on the basis of minimum earnings (at least £118 per week, rising to £120 from 6 April 2020) and because they have been unable to work. SSP is normally payable from the fourth day the employee is unable to work, at the rate of £94.25 per week (£95.85 from 6 April 2020), pro-rated per day. Employers may pay out under a company sick pay scheme from an earlier day of sickness, and at a higher rate of pay, but they are not obliged to pay anything other than the SSP rate. The conditions for SSP have been changed due to the requirement for people to self-isolate to prevent the spread of COVID-19 virus from the first sign of illness and to isolate if anyone in the household has symptoms of COVID-19. Employers are now required to pay SSP from the first day the employee is unable to work, rather than from the fourth day. This applies for periods of absence from work beginning on or after 13 March 2020.

SSP is also payable to employees who are self-isolating, even if they are not sick themselves, for example, where a member of their household displays COVID-19 symptoms. Employees can self-certify absences up to seven days

However, for periods of sickness from 13 March 2020, some employers will be able to claim a refund of some of the SSP paid. The system for claiming this refund has not been set up yet but the following conditions will apply:

- The employer must have had fewer than 250 employees on the payroll as at 28 February 2020.

- The amount of SSP refunded will be capped at 14 days per employee.

6 More time to pay taxes

The Government has introduced an immediate deferral of upcoming VAT and Income Tax payments due in the next three months, but the other business taxes such as PAYE and Corporation Tax remain payable on the due dates. HMRC is willing to enter ‘Time to Pay’ (TTP) arrangements where businesses or individuals are struggling to pay tax bills on their due dates. There are no set rules as each TTP agreement is arranged on a bespoke basis. However, HMRC must be confident that the arrears will eventually be paid; it will not enter a TTP agreement if it thinks that the taxpayer will never be able to pay the arrears of tax. Generally, TTP arrangements involve tax liabilities being deferred, without penalties, and paid over a period of up to a year, with fixed, agreed repayment schedules. It is imperative that the payment dates are not missed. If they are, the TTP arrangement is likely to be ended by HMRC, with the full amount of tax outstanding becoming immediately due and, potentially, penalties may be payable. TTP arrangements lasting over a year are only agreed in exceptional circumstances, although the Coronavirus pandemic may mean that HMRC will be more amenable to such longer scheduling of repayments.

7 Business Rates holiday

If your business occupies premises in England in any of the following sectors, you are entitled to a business rates holiday on your entire business rates bill for 2020/21, whatever the size of your business premises:

Retail, including all types of shops: opticians, post offices, car and caravan showrooms, petrol stations, car hire, garden centres, hairdressers, beauty salons, nail bars, travel agents, dry cleaners, funeral directors, letting agents and estate agents.

Hospitality, including: restaurants, cafes, takeaways, sandwich shops, pubs, bars, and live music venues.

Leisure, including: cinemas, hotels, bed and breakfast or self-catering accommodation, caravan parks, theatres, museums, art galleries, stately homes and historic houses, nightclubs, tourist attractions, gyms, casinos, bingo halls, sport grounds and sports clubs. You should not have to do anything to enjoy this business rates holiday, as your local authority will automatically reissue business rates bills for 2020/21.

Sectors which do not qualify for a business rates holiday on their business premises are:

• Medical services, including: doctors, dentists, vets, osteopaths, chiropractors • Professional services, including: solicitors, accountants, insurance agents and financial advisers

• Financial services, including: banks, building societies, loan providers, cash points and bureaux de change.

8 Grants based on rateable values

Small businesses who pay business rates may receive a grant from their local authority to help them through the COVID-19 pandemic. There are two levels of grant: £10,000 and £25,000. Businesses that qualify for the business rates holiday described above will receive a grant of £25,000 if their business premises has a rateable value of between £15,000 and £51,000. If the business premises has a rateable value of less than £15,000 the business will receive a cash grant of £10,000. In addition, all businesses in any sector in England which qualify for small business rates relief, or rural rates relief, qualify for a grant of £10,000. Businesses located in England do not have to apply for any of these grants as the local authority will write to the businesses concerned.

9 Loans for businesses

Even where a business is able to access one or more of the Coronavirus schemes made available by the Government (e.g. a grant under the CJRS to cover wages), there may be a significant time lag in that help being delivered. In the meantime, with a big drop in income occurring, the business may not have the funds to meet its ongoing costs. In order to help businesses through this difficult time, the new Coronavirus Business Interruption Loan Scheme (CBILS), delivered by the British Business Bank, has been launched. It is a temporary scheme to support, primarily, small and medium-sized businesses in accessing bank lending and overdrafts. The Government will provide lenders with a guarantee of 80% on each loan (subject to a per-lender cap on claims) to give lenders confidence in continuing to provide finance to SMEs. The Government will not charge businesses or banks for this guarantee.

Eligibility and terms

The scheme will support loans of up to £5 million, with repayment terms of up to 6 years. Businesses can access the first 12 months of that finance interest-free and charge-free, as the Government will cover the first 12 months of interest payments and any lender-levied charges. The loans can be in the form of term loans, overdrafts, invoice finance or asset finance. You are eligible for the scheme if your business:

• is UK based; and

• has turnover of no more than £45 million per year; and

• meets the other British Business Bank eligibility criteria. The borrower remains fully liable for the debt, but the Big Four banks have agreed that they will not take personal guarantees as security for lending below £250,000. For loan facilities above £250,000, the lender must establish that the borrower is unable to provide security, before it uses CBILS. However, primary residential property cannot be taken as security under the scheme. Note that if a lender can offer finance on normal commercial terms without making use of the scheme, it will do so.

10 Protection for tenants

Commercial properties

New protection Under the new Coronavirus Act 2020, no business will be forced out of their premises if they miss a rent payment in the next three months. This means that landlords will not be able to exercise any right of forfeiture on tenants that cannot pay rent during this period. Commercial tenants will still be liable for the rent arrears after this period ends though. The Government has said that it will actively monitor the impact on commercial landlords’ cash flow. Clearly, this measure will ease immediate cash flow problems for tenants. However, as the tenant will still be liable for the rent, this arguably is only delaying the problem rather than solving it. Who is affected? This applies to all commercial tenants of leases in England, Wales and Northern Ireland. It is expected to last until 30 June 2020 but could potentially be extended if deemed necessary.

Residential properties

From 26 March 2020, landlords must give their tenants three months’ notice that they want to end the tenancy. This means the landlord can’t apply to the court to start an eviction process until after this three-month period.

Mortgage protection Mortgage lenders have agreed to offer payment holidays of up to three months where this is needed due to COVID-19, including for buy-to-let mortgages. The sum owed remains and mortgages continue to accrue interest during this period. Where a tenant is unable to pay their rent, the landlord should discuss this with their lender, with a view to putting a mortgage payment holiday in place.

12. Claiming Universal Credit

If you don’t qualify for a Government grant under the Self-Employed Income Support Scheme (SEISS), or your employer has stopped paying your wages, you should consider claiming Universal Credit. This is a state benefit which is gradually replacing all current claims for Working and Child Tax Credits, but it also covers housing benefit and job seekers allowance. You can claim Universal Credit if you are under state pension age and living in Great Britain. The initial claim is made online (www.gov.uk/apply-universal-credit), but if you are claiming as a Self-employed person you will also need to attend an interview with a work coach. However, during the Coronavirus shutdown this interview will be conducted by telephone.

The amounts paid under Universal Credit are being increased from 6 April 2020 by £20 per week. All Self-employed claimants are normally assumed to make a minimum amount of income from their business which is referred to as the ‘minimum income floor’. However, this minimum has been temporarily suspended for all claimants affected by the Coronavirus shutdown. This means that every Self-employed person can now access Universal Credit at a weekly rate equivalent to Statutory Sick Pay received by employees. The Universal Credit claim will be paid in respect of the first day of the claim, but the money may still take up to five weeks to start to arrive. In this period, you can apply for an advanced payment, which will be deducted from the benefit when it does arrive.

(Click here) for the UK Government guideline link.

Facebook Comments